A PRACTICAL LOAN FOR MORE BORROWERS

QUICK QUALIFYING FOR LOANS UP TO $3 MILLION

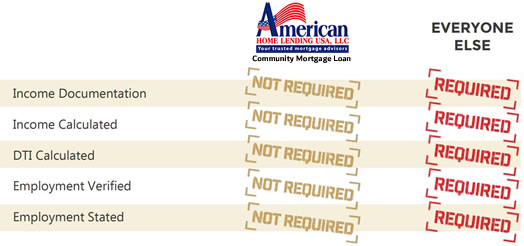

The Community Mortgage Home Loan is a return to common-sense underwriting. This innovative product addresses the regulatory rules limiting prime borrowers’ access to lending by eliminating unnecessary documents that are not part of the credit underwriting decision. This exclusive mortgage product is unique in the marketplace. Contact us or request a free quote today to learn more.

We deliver fast qualifying and closing with an innovative, marketleading loan program. Borrowers can qualify in three simple steps:

Benefits of Community Mortgage Loan

- Income documentation not required

- Income not stated

- DTI not calculated

- Credit underwritten based on LTV, FICO, and liquidity

- Primary residence and second homes

- Asset seasoning 30 days

- Loan amounts up to $3 million

- LTV up to 80% purchase/rate-and-term

- LTV up to 70% cash-out

- FICO beginning at 640

- Debt consolidation = rate/term

Community Mortgage Loan Ideal For:

- Self-Employed/Small Business Owner

- Volatile or Irregular Income

- Retired

- Seasonal & Gig Workers

- Real Estate Investors

- Owners & Employees of Cash Businesses

- Newly Self-Employed

- Transitioning from Recent Health, Family, or Other Life Events

- Looking to Tap Trapped Home Equity

- Recent Immigration

- Disqualified Income

The Community Mortgage Loan addresses the regulatory rules limiting access to lending by eliminating the unnecessary documents that are not part of the credit underwriting decision. This program is ideal if you’re self-employed, a small or cashbusiness owner, retired, or otherwise have a unique situation.